Content Summary:

Luxury’s Aversion to eCommerce

The Growth of Online Luxury Retail

The Journey of Net a Porter and Farfetch

The Pandemic and Rapid Switch to Digital

Price Markups among High End Retailers

Impact of Inflation on Luxury Industry

Supply Chain Impact on Luxury Retail

Redefining Luxury

-Luxury trends among younger generations

-Celebrities shaping 2022 luxury trends

-Sustainability (the greener side of luxury)

Luxury Retailers in the Metaverse

Intelligence Node Luxury’s Aversion to eCommerce

In the business of luxury, some codes have been evergreen- experience, quality, exclusivity. In strategically located brick and mortar stores, gilded in branded and high-end decor, and laid out to draw customers to their key products- luxury industry has long since been recognized for its tropes of extravagance. For brands like Givenchy, Chanel, Hermes, Dior, and Céline, among others, this expands to the end that the mere experience of purchasing and owning a luxury product is a curated, well-marketed statement in itself.

But in the era of all things digital, online, super-fast, and one click away- these codes don’t necessarily translate well. eCommerce, by nature, evolved to play the role of the accessible, quick and simple transactional platform; where the custom made, one of a kind, designer elements of luxury fall short of what is now expected from an online shopping experience- and more importantly, risk staining the opulence of the luxury experience.

More practically, luxury brands have historically remained wary of eCommerce for the lack of control of image, quality maintenance and experience of the sales environment, especially where third party multi brand sales platforms are involved.. However, as data began to prove that consumers were warming up to the idea of purchasing luxury goods online- how have these brands adapted to an evolving market? How have they evolved past their heritage and into the modern retail environment? As Deloitte stated in its research for Global Powers of Luxury Goods, “ Consumers are clear that they see the future of luxury as digital”

The Rapid Growth of Online Luxury Retail

Initially, industry stalwarts (Louis Vuitton, Burberry, Saint Laurent, Fendi) opted to test the waters and mediate their way into the online environment with partial online offerings. This included skincare, ready-to-wear products, accessories, and certain beauty products that were made available for purchase online, while the rest of their catalogs remained exclusive to stores. Online stocks were limited, and the approach was slow and strategic- leaning towards a gradual establishment of online presence in the future.

For some, however, this (for the time being) seems to be the end of the road: French fashion house Chanel holds a strong online presence- but decidedly not in retail. With over 40 million Instagram followers and strong communications online, the decision of keeping online sales extremely limited– just to cosmetics and accessories, basic brand staples and little else, has held strong, as the brand maintains its commitment to experience, quality, and service- offering their sought after fashion catalogs exclusively in store, with no promise to make them available online.

However, as competitor luxury retailers began to experiment with online sales, Chanel remained an outlier to the industry at large as uniquely, its model of business caters to a huge demand from a large consumer base, chasing a limited supply of curated designer label products. Often, such luxury houses have networks of clientele and directly supply high-end consumers, even making strategic partnerships with celebrities as their core focus for both marketing and sales. This alludes to an aspirational, value-driven, high society image in which the brand thrives- which made the appeal of accessibility to mass audiences negligible to the stakeholders.

“Our position on e-commerce is the same. We want to connect our customers with our product and our boutiques are the best way to do so. We are very consistent in our strategy, but we are using Farfetch’s know-how to accelerate this.“

-Bruno Pavlovsky, Chanel’s president of fashion

The Journey of Net A Porter & Farfetch

There do exist some interesting avenues through which high-end brands have directly dabbled in online sales, early on. Establishing itself as the “world’s premier luxury fashion destination”, Net a Porter, an eCommerce service, was set up in the early naughts, housing coveted designer brands’ products. It claimed to speak to a monthly audience of over 6 million to deliver to, curate, and manage customer relations for those interested in purchasing luxury goods online, across the globe. Its “you try, we wait” initiative delivered select goods directly to the homes of “EIP” clients (extremely important people) allowing them to try on and sift through the products, keep what they preferred, and call upon the service to collect the rest. These consumers made up 2% of the overall consumer base of NAP but generated a staggering 40% of sales for the service.

Similarly, Farfetch sought to “reimagine the luxury retail experience” through the use of technology, with the aim to create seamless consumer journeys that blend the best of online and in store shopping. It acts as an eCommerce solution to high-end labels- Despite heavy competition from players like YNAP and LVMH , FarFetch prevails and its gross merchandise value (GMV) hit 4.2 billion USD last yearr. It now holds a sizeable 6% of the online personal luxury goods market, valued at $68 billion.

The Pandemic & Rapid Switch to Digital

Luxury is as luxury does- but even the finest Maisons in the market were not universally shielded from the effects of the 2020 pandemic. Restrictions forced their hand on innovation and alternative approaches to online sales in an effort to stay afloat- or in the running against competing luxury retailers and luxury trends. According to the Bureau of Economic Analysis, in the USA, consumer spending on clothing and footwear dropped 9% to $362.4 billion in 2020. Parallel to this, the Census’ Monthly Retail Trade Report held that sales in clothing accessories performed even worse with a 24% drop to $204.2 billion in 2020.

Understandably, experts at the Boston Consulting Group had issued a cautionary prediction of poor performance in the luxury segment as well. However, as proven in the months of high retail sales volumes leading up to the pandemic, demand did not, and would not falter. Sales from luxury consumers held strong through the lockdowns and restricted months with only a quarter or so of lowered numbers for leading high-end brands.

As industry stalwarts sat down to crunch data from pre-pandemic, mid, and post-pandemic years from a broad selection of online luxury retailers (including NAP and FarFetch), their findings too were counterintuitive. Despite being steeled for losses and dips, they found that demand had increased- and sales were as high as ever. For example, Louis Vuitton, the largest luxury brand in the world, recorded a 12% increase in digital sales in 2020. An interesting explanation for this could be what is known as the LIPSTICK THEORY– where it is seen that especially in times of recession and economic distress, a consumer will set aside a budget and continue to create demand for select personal indulgences and luxury items such as a high-end lipstick, or personal good.

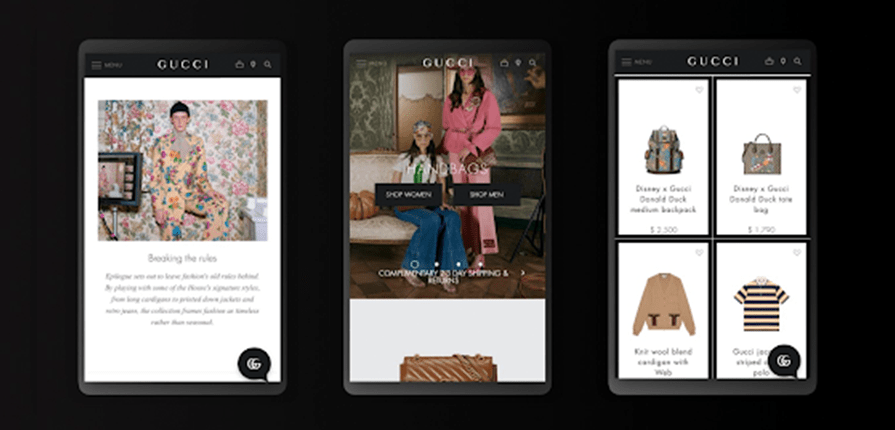

So as digital platforms and eCommerce pulled pandemic sales to soaring heights- and store closures pulled more and more brands online – the world saw luxury retailers and manufacturers like Rolex and Patek Philippe allow the sale of their products online for the very first time. While brands like Chanel continued to opt against eCommerce as a commitment to their brand and experience driven aesthetic, brands like Burberry, Gucci, and Cartier increased their online ad spends, social media, and commitment to online sales significantly during this time. Kering, owner of such brands as Gucci and Saint Laurent stated that eCommerce accounted for 13% of their sales in 2020, up from 6% the previous year.Prada, in a press release, reported that its online sales had grown 150%, despite total sales falling 40%. Bain estimates that by 2025, eCommerce could account for up to 30% of luxury sales– and further reports state that the online luxury fashion market is set to triple by the same year.

Evidently- turning as much of the end-to-end process digital- from supply chains to virtual showrooms for online prototyping and sampling, can help strengthen relationships with the modern day luxury consumer, and make high-end purchasing experiences accessible even in times of travel restrictions. Even outside eCommerce and marketing- digital presence for any brand is invaluable, and there are choices aplenty for brands to pick and choose between which online avenue may benefit their business the best.

Price Markups Among High-end Retailers

Another unexpected finding was that the prediction of deep discounts and promotions to attempt to increase sales during this time had been proven inaccurate. While in 2020 the share of markdowns on designer and luxury handbags, for example, skyrocketed to a whopping 20% by April, this quickly reversed- and by August a mere 7% of bags were marked down, and 10% showed a markup in price. Louis Vuitton as well was pushed to place discounts on roughly a third of its bags in the latter half of 2020, but again, even in early 2021 no discounted products were seen across high end retailers. Even the average price of high-end jewelry sold online doubled between 2019 and 2021- reflective of the overall luxury market whose online shares have more than doubled since 2019.

This era indicates a rapid scramble across multiple high-end retailers to determine the ideal pricing strategy- watching competitor behavior and retail trends as they played out. Identifying these moments- such as the increased willingness of the luxury consumer to pay full price, and the price markups of competing brands, helps major players stay in the arena. But the ability to track competing brands and products in real-time, and study real-time performance of different pricing approaches, puts any brand at a distinct advantage to maximize performance, even compared to competing brands. Intelligence Node’s intelligent pricing tools and AI-driven price analytics help retailers ride rapidly changing trends and consumer preferences on the fly- combined with the flexibility of eCommerce, this tool allows brands to effectively manage product inventory and optimize sales without missing a beat.

A lot of these brands’ success can be credited largely to digital sales. In 2020 Bain reported that nearly one fourth of luxury goods purchases were made online- demand was so high that customers were willing to be put on waiting lists, and a total shift in consumer behavior in this space was observed. Optimizing assortments and inventory plans based on these findings for the future could hold great promise for new use cases of luxury as not only extravagance but durable and high quality personal goods meant to last through the ages.

Impact of Inflation on Luxury Industry

This is how, many have reported, the luxury sector has managed to sidestep inflation: by not only catering to an extremely upscale client base who is not price-conscious, but positioning its products as evergreen fashion pieces for the ages. The perceived value of these labels has held strong through economic crises as worthy investments and safe bets within the fashion and personal goods expenditure for any consumer.

Mass production and cheaply made goods take a big hit in such times with the fact that the masses to whom these products are targeted are price conscious to begin with. However in the case of luxury- as Nordstrom states, its sales performance was well insulated by the demographics and average earning trends among its consumer base.

While the demand end of the business of luxury retail holds strong- the pandemic quickly called into question major players’ vulnerability to changes in supply.

Supply Chain Impact on Luxury Retail

As an industry, high-end fashion is known for one-of-a-kind, hard-to-get, small batches of designer label products that evolve by season to cater to select clientele or for the lucky few who get their hands on them. For example, Gucci produced on average 880 to 1000 bags a month for retail stores. It’s here that the importance of clientele and the history of these labels come into play- and the branding of high quality Italian craftsmanship. When products were exclusive, so were producers of such products. But the gap between demand and supply suddenly gaped in the pandemic- (after a brief dip in demand in the initial months), and demand heavily outweighed supply, more so than usual. This, in addition to the drastic price markups, was largely owing to severe supply chain issues globally- and the fact that China (a source of high demand) and Italy (the source of the products themselves), were the worst hit by the first year of the pandemic.

Also read about : Premium Pricing: The Ins & Outs of a Successful Brand Strategy

More than a whopping 40% of luxury goods production takes place in Italy, with small family-based manufacturers called façonniers, a signature (and trappingly rigid) element of the luxury ecosystem. However, when the pandemic struck, a majority of these contract manufacturers shut down as well- halting supply due to the obvious lack of agility in production. Brands who simply sourced material from Italy but manufactured elsewhere had the freedom to source from new suppliers, a challenge for the quality control of products and maintaining brand credentials along with the perceived value of the products.

For these reasons, it has been reported that the luxury business needs to adopt a much faster decision-making process, and revise its operational model to match current trends, or at least make itself more resilient to a dynamic market, and match the pace of a changing world. Relationships with mass suppliers and management of logistics have become matters of extreme urgency. Additionally, as consumer bases evolve and perspectives shift- the mere definition of luxury and high-end buying may be called into question as a new generation steps into the consumption limelight- urging the major players of retail luxury to step out of their comfortable heritage driven branding and brace for evolution.

Redefining Luxury in the Digital Era

-

Luxury Trends Among Younger Generations

As Gen Z and the Millennials start to take the place of their predecessors as the biggest purchasers and spenders in the market, the image of value begins to shift- along with a new economic environment, increasing consumer awareness, and the environmental crisis. With that change, the outlook of luxury is prone to change as well.Will the new generations hold as much value for heritage, elite brands, or will they shift interest to popups and boutiques as up and coming designers take the spotlight? As mass brands create limited edition and designer collaboration capsules with celebrities and fashion houses, ‘hype drops’ have garnered mass interest as innovative new fashion trends gain traction. Nike, for example, has released immensely successful capsules with Kanye West, Atmos (Tokyo based boutique), Comme des Garcon, Drake, and more- all of whom have helped bring streetwear like sneakers to high end runways.

-

Celebrities Shaping 2022-23 Luxury Trends

Celebrities themselves have now jumped into the world of luxury, creating contemporary luxury fashion brands. Kanye West’s “Yeezy”, a fashion brand under ADIDAS boasts exorbitantly priced shoes and modern designs that sell out within minutes of launch. FENTY (a partnership with luxury house LVMH) by Rihanna is set to challenge the core ideas of luxury as we know it, as it heralds the tagline “Beauty for all”, a direct clash against the decades of ‘hard to get’ exclusivity set by heritage brands. Clearly, the modern day luxury consumer seeks more than heritage alone- a healthy mix of design, pop culture, the designers behind them, and the thematic hype and exclusivity of it all contribute to what they may consider luxury fashion, in line with modern style. Even age-old brands like Cartier have taken note of this, making an effort to appeal to the modern consumer- their partnership with YouTuber and media personality Emma Chamberlain, sparked heavy media attention by showcasing one of their most valuable (and controversial) diamond neckpieces in her look for this year’s MET Gala, a luxury event hosted by Vogue’s Anna Wintour.

Also read about : The Beauty Industry Glow Up of 2022 & Beyond

• Sustainability & the Greener Side Of Luxury

As far as sustainability is concerned, younger consumers are already predisposed against fast fashion and mass retailers like H&M. Where does that leave luxury? To meet consumer demand for greener practices, the industry is slowly incorporating changes in their retail and general operations- using recycled materials for shopping bags, and in the case of LVMH, using deadstock (as the unused leftover fabric is known) to launch Nona Source, an online resale platform for deadstock materials collected from all the production houses of LVMH across brands. Hermes, Alexander McQueen, Prada, and more have all made serious efforts to invest in and create new luxury fashion from sustainable and ethical materials. Vegan fashion is no longer as niche as it may seem, cutting out animal testing, any use of animal products, no cruelty, and the PETA approved seal of vegan fashion.

Luxury Retailers in the Metaverse

Evidently, ‘modern’ and ‘luxury’ are not total oxymorons- much like Cartier, many top upscale luxury retailers have made strong attempts to catch on to certain trends and merge into the purview of the modern consumer- either in ambassadorships, media marketing, online presence, or new technology. Augmented reality, for example, is enabling beauty brands and certain fashion brands to provide virtual try-ons of products for their consumers to test shades and hues against their own skin, and sample different products from a brand’s catalog with 3D visualization. For brands that insist on in store experiences, enhanced mirrors (smart mirrors) allow customers to intuitively interact with products and quickly gather relevant information like price, materials, origin, etc. Artificial Intelligence can better predict the changing buying habits of consumer segments and provide advanced recommendations for purchases- and today, almost every smartphone has an AI assistant pre installed, making this feature accessible to anyone with the tech know-how. A study by Verto Analytics found that 98.6% of people with access to an AI assistant on their phone used it at least 10 times a month.

In VR, Balenciaga hosted a fashion show themed to match their dystopian video game, “afterworld: the world of tomorrow”, with space suits and end times style clothing displayed on virtual models. Fortnite, a popular game among young audiences, partnered with Balenciaga to create a fashion line that was entirely virtual for their in-game characters, closely followed by their real life collection available for the players to purchase. PUB-G even boasts a fashion week as a social event for gamers within the universe to show off virtual clothing and ‘skins’ and items (purchased often with real money). Louis Vuitton has partnered with League of Legends for a fashion line in both virtual and physical realms, with AR try-ons and experiences for players. Today, AR clothing targeted at influencers has begun to infiltrate social media- aiming to reduce textile waste for online fashion content creators who tend to purchase clothes solely for photoshoots and social media.

Final Word

Wherever you log in- social media, video games, personal shopping apps, or even your phone’s virtual assistant- luxury is close to follow. From heritage status symbols to a representation of your beliefs, identity, and style through designer labels, there is a luxury house for every type of consumer: and identifying that consumer, understanding them, and knowing how to mold your business around them, is a key step to success as a luxury retailer in the near and far future.

Identify the trends among your consumers, competing brands, and comparable products in real-time with Intelligence Node’s advanced AI pricing analytics and market intelligence– download the Savvy Shoppers & the Need for AI Pricing eBook by Intelligence Node to start your journey!